Condo Insurance in and around Roswell

Welcome, condo unitowners of Roswell

Condo insurance that helps you check all the boxes

Your Stuff Needs Insurance—and So Does Your Townhome.

Are you committing to condo ownership for the first time? Or have you owned one for a while? Either way, it can be a good time to get coverage for your unit with State Farm's Condo Unitowners Insurance.

Welcome, condo unitowners of Roswell

Condo insurance that helps you check all the boxes

Agent Sophia Vanden Bout, At Your Service

With this insurance from State Farm, you don't have to be afraid of the unpredictable happening to your biggest asset. Agent Sophia Vanden Bout can help lay out all the various options for you to consider, and will assist you in creating a terrific policy that's right for you.

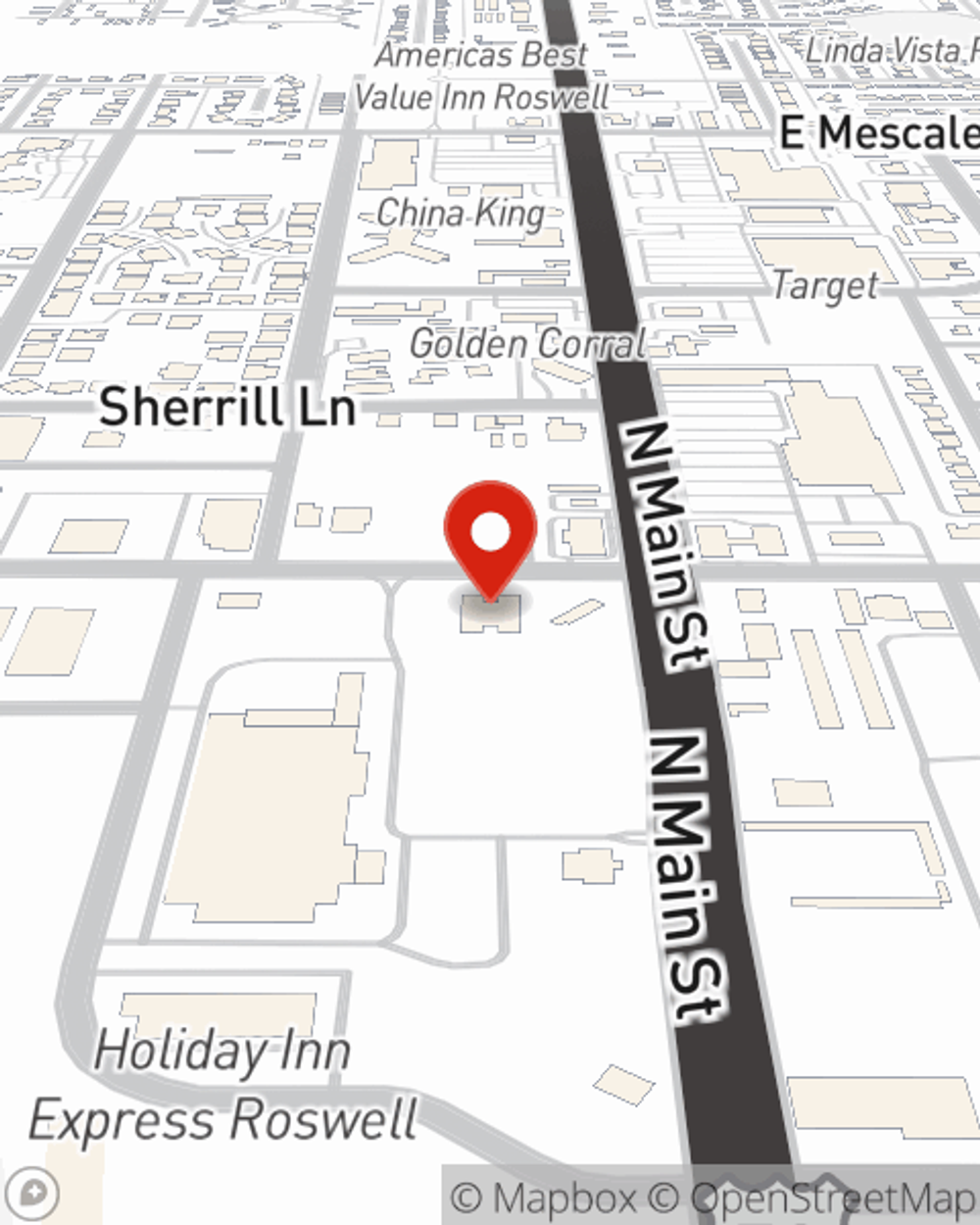

Roswell condo owners, are you ready to check out what a company that helps customers by handling thousands of claims each day can do for you? Get in touch with State Farm Agent Sophia Vanden Bout today.

Have More Questions About Condo Unitowners Insurance?

Call Sophia at (575) 208-0137 or visit our FAQ page.

Simple Insights®

Help raise your home's worth with these simple appraisal tips

Help raise your home's worth with these simple appraisal tips

Appraisals provide an estimate of your home's value for determining its worth and are required when selling or refinancing a home or property.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.

Sophia Vanden Bout

State Farm® Insurance AgentSimple Insights®

Help raise your home's worth with these simple appraisal tips

Help raise your home's worth with these simple appraisal tips

Appraisals provide an estimate of your home's value for determining its worth and are required when selling or refinancing a home or property.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.